More than Rs. 30 crore skimmed off Indian credit card users over 2 months

Over the last few days it has come to light that a global syndicate has been skimming Indian credit card users for the last 2 months. Several cases have been reported where people’s credit card bills and registered mobile numbers have shown fraudulent and unauthorized transactions. It is believed that the total unauthorized transactions so far amount to more than Rs. 30 crore.

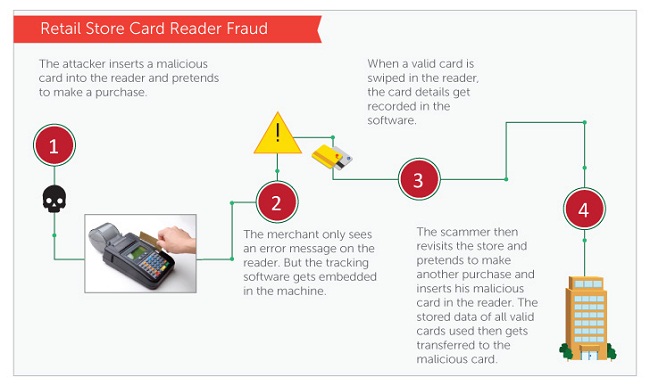

Bankers believe that the stolen credit card information has been gathered via compromised retail outlets and stores. Such stores possess card swiping machines which can be skimmed by hackers to reveal the details of all cards that are swiped through them. Once the card information has been gained, it can be utilized to carry out fraudulent online transactions or the card itself can even be physically cloned.

With that in mind, here are some useful tips for credit card users:

- When carrying out a transaction in a retail store or restaurant, ensure that the card is not taken away from your view. If this is not possible, use cash instead.

- Do not use your credit card at every retail store that you visit.

- While using an ATM, ensure that the machine does not seem tampered with or rigged. Also be aware of any suspicious activity or person around you.

- When carrying out an online transaction, use the virtual keypad to enter your card number and other details.

- Ensure that your mobile number is registered with your credit card so that you receive an SMS every time a transaction is completed.

- Install an effective anti-phishing software on your computer especially if you carry out online transactions.

In good news, domestic portals in India are better equipped to deal with such cases. Online credit card transactions here require the buyer to give his name, card number, expiry date, CVV number and his online banking password. For international transactions, the online banking password is unnecessary. However, this also means that fraudulent transactions are mostly carried out in foreign currencies.

The affected banks claim that customers who can prove that they did not make a transaction will get a refund, but this will need to be processed and investigated efficiently. Some banks also take insurance covers if fraudulent transactions cross certain limits. The Reserve Bank of India (RBI) has also issued a mandate that requires banks to adopt chip-based cards for international transactions by June 2013.

We will update our readers when further developments regarding this global syndicate are revealed.

36 Comments

this card tips is very useful.

The menace of cloning of credit cards by card swap machines and ATMs has been around for few years.

It is time that regulatory authorities make it mandatory for banks and international virtual money facilitators lie VISA, MASTER CARD, AMEX, DINER, etc. to encode security features to protect card holders’ details, and also provide encoded alerts, which should detect attempted cloning and raise and audible alert at the vendor’s swap machine, and activate card retention at the ATMs.

In this article you have suggested the user to use virtual key pad to avoid phising.And strangely you donot provide the virtual key pad to your customers.Whereas kaspersky provides it. do you only preach and not practise.

Hi Ramesh,

This virtual keypad is an inbuilt feature of Windows. You can use it by pressing Windowskey + R (to open the Run window) and then typing “osk”. Additionally, most banking portals provide their own virtual keypad. So if you buy a product from our website there are many ways to use a virtual keypad.

Regards.

Thanks for updation

Can you suggest some good anti phishing s/w with its source and price for personal transactions?

Hi Jayant,

Quick Heal 2013 has excellent and advanced anti-phishing features. You can explore our product list for home users by visiting this link – https://www.quickheal.com/in/en/home-users.

Regards.

excellent.

TEAM ITS TWO TIMES WHEN YOUR QUICK HEAL STOPS WORKING WHILE I WAS SURFING MY WEBSITES. AND I DID,T KNOW WHAT IS REASON BEHIND IT. AS QUICK HEAL SAYS IT DETECT ANY VIRUSES THAT’S WHY I PURCHASES IT BUT I THINK IS IS WASTE OF MONEY. I AM MENTIONING MY LAST WEBSITE WHICH SHOWS ERROR..

ITS {MINI CLIPS.COM}. PLEASE FIND THE GENUINE SOLUTION AND PLEASE GET BACK TO ME..

THANKS TEAM,

JATIN.

Hi Jatin,

We apologize if you feel that our product has not served you well. However, if a certain website has been blocked by Quick Heal it is because the website contains some malicious content that is recognized by the product. To speak with our support center and better understand the situation feel free to call us at 927-22-33-000.

Regards.

Thanks for the update

thanks for reminding all innocent indian credit card users to be vigilant so that their hard earned money is not siphoned by the culprits.

Thank you.

thanks for the update

Thanking You for giving that important tips.

LUCKILY, HERE IN PANAMA MOST OF THE CREIT CARDS ARE insured (THE USER PAYS FROM US$3 to US$5 AS MONTHLY PREMIUM & IS 100% COVERED FROM ANY FRAUD &/or CARD ROBBERY).

I THINK IT’S HIGH TIME THE BANKS IN INDIA & OTHER COUNTRIES ADOPT THIS METHOD SO THAT THEIR CARD USERS WITHOUT FEAR CAN USE THIS PRODUCT ANYWHERE NO MATTER WHETHER IT’S A PAANWAALA kiosk OR A 7-STAR HOTEL!

WITH BEST WISHES,

PRITAM TEWANEY

PANAMA

+507-6675-4701

WWWdotAIYELLOWdotME

It is indeed very useful and awareness information. It is high time that banks put condition that merchants should arrange to swipe the card in customer’s view. Often in hotels / restaurants/ petrol pumps card is taken out of customers’s view for quite some time, which need to be prohibited. Also some banks ( Axis) is issuing chip based cards. Transaction in online is very confusing, whether it is safely done, or compromised, difficult to understand. Software firms / banks can find out some remedy so that we feel confident and relaxed while doing transaction , rather than spending tense days & nights till nothing happens for some months.

thanks

sir thnks for the information..

and please just tell me one very good antu phising software..which i can install in my laptop..

Hi Shivam,

Quick Heal 2013 provides advanced and effective anti-phishing software and tools. You can read more by visiting our products page – https://www.quickheal.com/in/en/home-users.

Regards.

These frawds can be eliminated by adopting an initiation 5/7 letter password.

similar to bank lockers. even if the original card is lost nobody can use the same without knowing the initiation password.

It is like double lever lock.

How do you give this initiation password.

thanks sir

This may not be the proper place to put up this ques but I’d like to know that is it easy to clone a credit card that has both a chip and a magnetic strip?

Hi Rahul,

It is much harder to clone a credit card that has a chip and a magnetic strip. The chip can be programmed to contain assorted information so it gives the banks an effective defense mechanism.

Regards.

thanks for such knowledge update

do Quick-Heal & Guardian include anti-phishing capabilities. else can u recommend such a software.

Thanks.

Hi Milind,

Yes Quick Heal products do possess advanced anti-phishing features and capabilities.

Regards.

This information may be given as a circular along with monthly bills by the banker to create more awareness.

Thnks its worthy

VERY USEFUL INFORMATION, THANKS.

Thanks for the update. Very useful tips.

VERY GOOD INFORMATION

GOOD AND GOOD

I tried Some Free Antivirus Applications including AVG & Avast and thought they’ll work as my old and faithful Quick Heal but after using few days I saw my laptop is a store house for virus and spywares! I was scared because I do shopping online and was afraid about my my financial details. And that’s why I’m back to my Old Friend Quick Heal

Thanks for such a crucial info..

Really thanks alot