Security Habit Series: Stop fraudsters from VISHING away with your money!

There has been a a lot of developments in the last two months for Quick Heal. We are listed as a public limited company; our security solutions were recognized and awarded in the US and as a public limited company we made our first debut at RSA 2016, world’s biggest security conference.

And, hence the break in Security Habit Series!

Moving on, let me take you through an incident that happened in my family. The other day my uncle, a senior citizen, received a call from an “executive of a renowned bank” where he happens to be a privileged customer. The bank OTP was generated on his registered mobile and the executive asked him to share the OTP for customer verification. Not at all tuned with the latest changes in mobile and online banking, my uncle shared the OTP with the executive. The call was disconnected and in seconds he received a bank message stating that INR 10,500 was debited from his account!

My uncle’s telephone banking experience defines the No.3 Security Habit to follow: Learn the Dos and Don’ts of Safe Mobile and Internet Banking

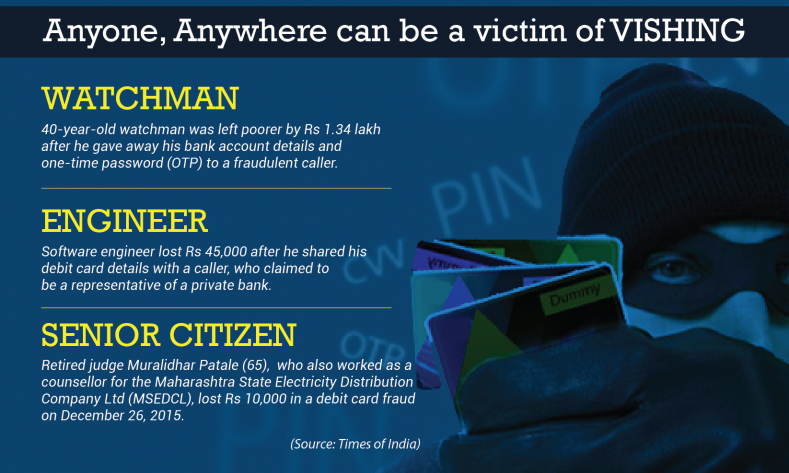

It is not very difficult to understand that my uncle became a victim of telephone banking fraud. In information technology terms, this trick is called VISHING, a combination of VOICE and PHISHING. A direct phone call to the victim is the most common form of vishing attack followed by emails, mobile text messaging and voicemail amongst others.

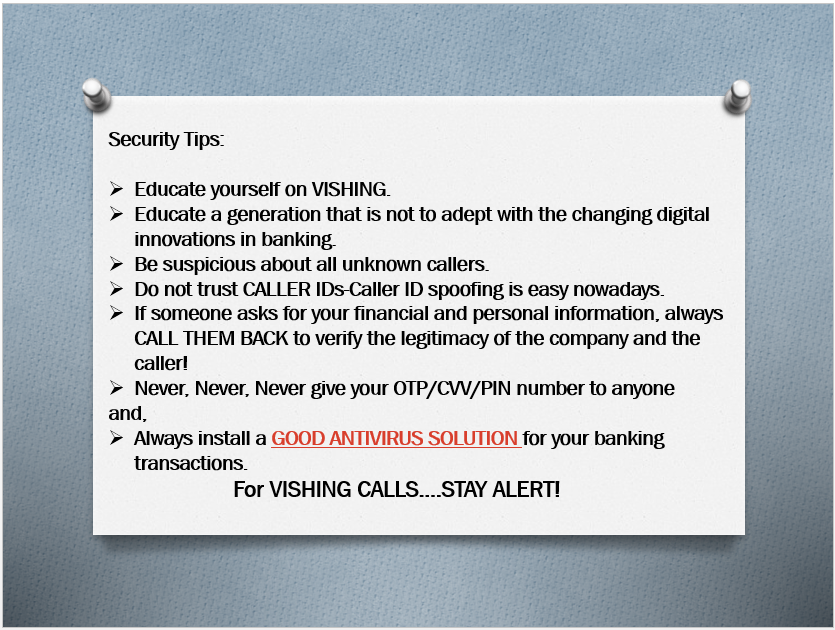

Having a little understanding of the profession I am into, my uncle wondered whether an antivirus solution will protect him from such fraud calls. A good antivirus solution will protect your online banking activities from fraudulent websites and malicious programs that steal financial information. It provides a safe session where your financial transactions on banking portals, shopping and other e-commerce websites stay private and hidden from hackers. As experts, we always tell you to be ALERT.

Frauds and hackers do not care to understand the situation you are into. They would love to take advantage of a situation that gives them easy information and money. The general “ignorance” of users, especially senior citizens, towards digital safety makes their task easier.

So, next time you are enjoying the benefits of online and mobile banking, educate yourselves on the following,

- A one-time password(OTP) is a password that is valid for only one login session or transaction, on a computer system or other digital device. Banks will only generate an OTP when you are “personally” doing an online transaction.

- Do not trust unknown callers.

- Do not share OTP, CVV, PIN and debit/credit details with anyone, even if the person claims to be a bank official.

- Fraudsters/hackers are primarily motivated by money and the most likely thing that they will target is your banking accounts, debit/credit cards and other payment accounts.

- Senior citizens are the most gullible victims as many of them are not tech-savvy. However, the savviest also do fall prey to vishing!

- Fraudsters are experts and well-trained. Their behavior will seem too professional and polite as if they are actual executives of the bank.

ARE YOU A VICTIM?

Act Now… It’s Your Money!

Money once lost through cyber frauds is hard to retrieve. And, if you waste time repenting over it, it is as good as gone.

STEP 1: Inform your bank immediately and block your card.

STEP 2: Register a complaint with cybercrime cell or local police station. Specify every minute detail of the conversation.

STEP 3: If you are using the social media for registering your complaint, remember not to share your card details and phone number. You are preparing yourself to get noticed by another fraudster!

Fraudsters love money and they would love coming back to you. So, the next time you receive a call from someone asking you to share your OTP/CVV/PIN or any other details, just say NO! Vishing ends there!

1 Comment

Thanks for this nice article.