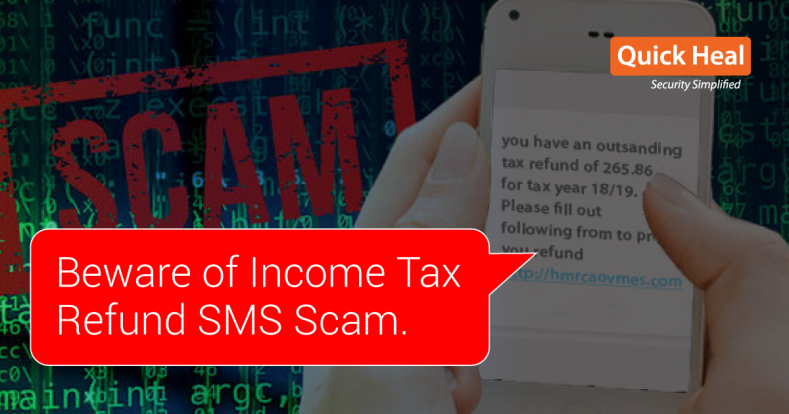

Alert! Income tax refund SMS – Newest way of conducting bank fraud by cyber criminals

Scammers are literally on their toes all year round, but for all the wrong reasons, devising ways and means to trick innocent people. In their latest attempt at fraud, cyber criminals are using fake SMS pretending to be from Income Tax Department to trick innocent victims into sharing bank account details.

Understanding Income Tax Refund Scams

Income tax refund scams come in various forms, but they all share a common goal: to deceive taxpayers into revealing personal and financial information. Some of the most common types of scams include:

Phishing emails claiming to be from the IRS or tax preparation services

Fake websites that mimic legitimate tax-related platforms

Phone calls from scammers posing as IRS agents or tax professionals

These scams often create a sense of urgency, pressuring victims to act quickly without verifying the legitimacy of the request. Scammers may threaten legal action, penalties, or even arrest if the victim doesn’t comply with their demands.

Common Tactics Used by Cyber Criminals

Cybercriminals employ various tactics to deceive taxpayers and steal their information. Some of the most common tactics include:

Phishing Emails and Messages

Scammers send fake emails or text messages that appear to be from the IRS, tax preparation services, or even your bank. These messages often contain links to malicious websites or attachments that can install malware on your device. The goal is to trick you into providing personal information, such as your Social Security number, bank account details, or credit card information.

Fake Websites and Apps

Cybercriminals create fraudulent websites or mobile apps that closely resemble legitimate tax-related platforms. These fake sites may ask you to enter sensitive information, such as your login credentials or financial data, which the scammers can then use for identity theft or financial fraud. Always double-check the URL and look for signs of a secure connection (HTTPS) before entering any information.

Phone Scams

Scammers may call you, claiming to be IRS agents or tax professionals. They often use high-pressure tactics, such as threatening legal action or arrest, to create a sense of urgency and fear. The goal is to extract personal information or convince you to make an immediate payment. Remember, the IRS will never initiate contact via phone to demand payment or request personal information.

How Scammers Hook Victims with Deceptive SMS

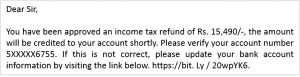

At a time when people across the country are getting ready to file their I-T returns, an SMS like below, confirming a refund and asking you to verify your bank details can seem quite genuine.

Note that the message opens on a good note to instantly attract your attention, immediately followed by a wrong bank account number. The message continues to smoothly trick you into verifying your account number if wrong, simply by clicking the link, ultimately making you an unsuspicious victim of the fraud.

The whole purpose of the message is to hook and dupe tax payers with the wrong bank account number (purposefully so) and force them to click the website link, in an attempt to rectify the error. The fraudulent link opens up to a website similar to the genuine I-T department website and the victim is asked to enter their login details created on the actual I-T department website.

Without wasting any more steps, the victim is asked to enter the correct bank account details, which in turn can easily be accessed and abused by cyber criminals.

Once fraudsters have the correct bank details, they call unsuspicious victims posing as I-T department officials and cheat them out of money, by convincing that they have been irregular with their I-T returns and thus, require to pay the requested fine, which the victim usually does.

Unfortunately, the scam doesn’t stop at that but rather is just the beginning. With access to the correct login details on IT department website, fraudsters can now easily transfer I-T funds from victim’s account to their own account or may simply modify their details like phone number, email ID, etc. which are often used for validation purpose.

Protect Yourself: Precautions Against Tax-Related Scams

While you cannot completely stop such messages from landing into your inbox, as a precautionary measure, here are few things you can surely do:

Never share your financial details like bank account number, PIN, OTP, etc. by responding to SMS, emails or phone calls since, genuine I-T department NEVER asks you for it.

DO NOT click on links or attachments received through SMS or emails unless absolutely sure, as these may be malicious.

Be absolutely wary of links that ask you to share personal information, just in case you inadvertently happen to click such a link.

Keep your eyes open for errors like bad grammar or spelling mistakes in such SMS or emails. Usually the letters in the URL also appear jumbled.

Most importantly, be cautious of your actions and reactions and DO NOT trust things blindly, to save yourself from falling into the hands of scammers and fraudsters waiting for soft targets like you.

How Quick Heal Can Safeguard You Against Tax Refund Scams

Quick Heal Total Security offers comprehensive cybersecurity solutions that can help protect you from various threats associated with income tax refund scams. Some of the key features include:

Real-time threat detection: Quick Heal’s advanced algorithms can identify and block malicious emails, websites, and attachments in real-time, preventing you from falling victim to phishing attempts.

Web protection: The built-in web security features warn you about suspicious websites and prevent you from accessing known phishing sites, reducing the risk of inadvertently providing sensitive information to scammers.

Email security: Quick Heal scans incoming and outgoing emails for potential threats, including malicious attachments and links. This helps protect you from email-based tax fraud scams.

Malware protection: With robust malware detection and removal capabilities, Quick Heal can safeguard your devices from various types of malware, including those associated with tax relief scams.

Conclusion

Income tax refund scams pose a significant threat to taxpayers, with cybercriminals constantly evolving their tactics to steal personal and financial information. Remember to be cautious of unsolicited emails, phone calls, or tax refund SMS messages claiming to be from tax-related entities.

By staying informed, using reliable cybersecurity solutions like Quick Heal Total Security, and maintaining a vigilant mindset, you can safeguard your sensitive information and protect yourself from the damaging consequences of income tax refund scams.

No Comments, Be The First!