Blockchain & Fraud Prevention: Strategies to overcome the cryptocurrency scam

Cryptocurrency has revolutionized financial transactions, offering speed, anonymity, and decentralization. However, the rise of cryptoscams has become a significant concern for investors and users alike. As the popularity of digital currencies grows, so do the sophisticated trading scams that exploit vulnerabilities in the system. In this blog, we’ll explore how blockchain crypto technology can be leveraged to combat fraud and protect users from falling victim to these scams.

What is Cryptocurrency?

Cryptocurrency is a type of digital currency that generally only exists electronically. There is no physical coin or bill unless you use a service to cash in cryptocurrency for a physical token. You usually exchange cryptocurrency with someone online, with your phone or computer, without using an intermediary like a bank. Bitcoin and Ether are well-known cryptocurrencies, but there are many different cryptocurrency brands, and new ones are continuously being created.

Cryptocurrency Terms You Should Know

Blockchain: A blockchain is a type of database in which a cryptocurrency’s digital transaction records are stored in groups or blocks. New blocks are continually created as extensions of the previous block, forming a chain. These blockchains build upon themselves within the database, storing an ever-increasing amount of data about the transactions for a specific cryptocurrency.

Decentralized: In the context of cryptocurrency, the term decentralized means the currency isn’t backed by a central bank or other financial institution.

Distributed ledger technology (DLT): A decentralized digital record Unlike typical databases, there’s no central authority. The record is stored across multiple locations simultaneously, and once a transaction is recorded, it’s permanent. Block-chain is a type of DLT.

Bitcoin: The first cryptocurrency and still the most popular today.

Altcoins: Any cryptocurrency that is not Bitcoin. Some popular altcoins today include Ethereum, Dogecoin. These altcoins each have different features and purposes.

Exchange: A marketplace where you can buy and sell cryptocurrency.

Wallet: A place to store your cryptocurrency holdings.

How People Utilize Cryptocurrency in Daily Life

Cryptocurrency offers a range of benefits that make it attractive for daily use. People use digital currencies for quick, low-cost payments, avoiding the transaction fees associated with traditional banks. The pseudo-anonymity of cryptocurrencies also appeals to those seeking increased privacy in their financial transactions.

Additionally, many individuals hold cryptocurrency as an investment, speculating on its potential value appreciation. The decentralized nature of cryptocurrencies eliminates the need for intermediaries, giving users more control over their funds.

How to Acquire Cryptocurrency?

Acquiring cryptocurrency is a straightforward process. The most common method is through online exchange platforms, where users can buy, sell, and trade various digital currencies using fiat money or other cryptocurrencies. These exchanges often require users to complete a registration process and verify their identity to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Alternatively, some individuals earn cryptocurrency through a process called “mining.” This involves using powerful computer hardware to solve complex mathematical problems and validate transactions on the blockchain network. Successful miners are rewarded with newly minted coins for their contributions to the network’s security and integrity.

Known issue while paying with Cryptocurrency

Cryptocurrency payments do not come with legal protections: Credit cards and debit cards have legal protections if something goes wrong. For example, if you need to dispute a purchase, your credit card company has a process to help you get your money back. Cryptocurrencies typically do not.

Cryptocurrency payments typically are not reversible: Once you pay with cryptocurrency, you can usually only get your money back if the person you paid sends it back. Before buying something with cryptocurrency, know the seller’s reputation, where the seller is located, and how to contact someone if there is a problem. Confirm these details by doing some research before you pay.

Some information about your transactions will likely be public: People talk about cryptocurrency transactions as anonymous. But the truth is not that simple. Some cryptocurrencies record some transaction details on a public ledger called a “blockchain.” the information added to the blockchain can include details like the transaction amount and the sender’s and recipient’s wallet addresses.

How to Spot Scammers: Warning Signs to Watch For

Scammers guarantee that you’ll make money: If they promise you’ll make a profit, that’s a scam even if there’s a celebrity endorsement or testimonials. (Those are easily faked.)

Scammers promise big payouts with guaranteed returns: Nobody can guarantee a set return, say, double your money much less in a short time. Scammers promise free money. They’ll promise it in cash or cryptocurrency, but free money promises are always fake.

Scammers make big claims without details or explanations: Smart business people want to understand how their investment works and where their money is going. And good investment advisors want to share that information.

How Scammers Target Individuals

Scam Websites: Scam websites work in various ways, from publishing misleading information to promising wild rewards in a financial exchange. The end goal is almost always the same to get you to relinquish your personal or financial information.

Fake Mobile Apps: The most dangerous type of fake apps is apps that contain malware. These apps can infect your smartphone with viruses and other malware that will work to get access to your personal information, account data, passwords, and more.

Social media scams: Scammers can hide behind phony profiles on social media, using ads and offers to market their scams. They can take over an account or trying to get money, personal information, or both.

Phishing emails: Phishing emails and text messages often tell a story to trick you into clicking on a link or opening an attachment. They may say

they’ve noticed some suspicious activity or log-in attempts

claim there’s a problem with your account or your payment information

say you must confirm some personal information

include a fake invoice

want you to click on a link to make a payment

say you’re eligible to register for a government refund

offer a coupon for free stuff

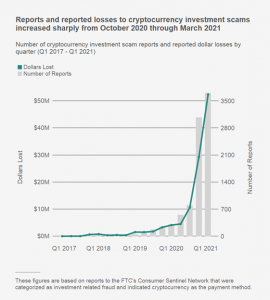

Fake Initial Coin Offering (ICO): Fraudulent ICOs and sketchy coins and tokens abound, but there are many ways to help ensure that you avoid these potential scams. One of the best ways to protect yourself is to thoroughly research the individual team members of a project before you invest. The Federation Trade Commission (FTC) published a report on crypto investment scams. The scams amounted to a loss of more than $50 million also investors belonging to the age group of 20 to 40.

Source: FEDERAL TRADE COMMISSION

Scams Caused by Viruses and Malware

New strategies and creative attempts to breach into an investor’s wallet can at times be tedious. The new ways to execute wallet breaches, hackers, and criminals resort to age-old malware and viruses to gain access to crypto wallets. For this reason alone, two-factor authentication and trusted Anti-virus like Quick Heal Total Security can be a protective shield for crypto-wallets.

Modern malware that targets cryptocurrency users and investors can latch onto the user accounts to retrieve the user’s online wallet balance, drain their account and replace their authentic address with that of the scammer.

Apart from updating your Quick Heal antivirus and system firewall, you need to make sure that you are visiting a secure and trustworthy platform that does not prompt auto-download of .exe files or ask you to download suspicious attachments.

How Quick Heal protects you against such threats

Quick Heal’s dedicated malware analysis team conducts continuous threat research to stay ahead of emerging crypto mining scams. By analyzing the latest defi wallet scams and cyber currency scams, they strengthen Quick Heal’s security products, indirectly protecting users from falling victim to these threats. Quick Heal Total Security offers a comprehensive suite of features designed to safeguard against digital currency fraud:

Web Security: Provides first-level protection against online attacks, including phishing protection, browsing protection, intrusion detection and prevention (IDS/IPS), and a robust firewall.

Anti-Ransomware (ARW): Detects and blocks suspicious activities such as unauthorized encryption, deletion, or modification of files, preventing ransomware attacks.

Conclusion

As the adoption of cryptocurrency continues to grow, it is crucial to remain vigilant against the ever-evolving landscape of cryptoscams. By leveraging the transparency and immutability of blockchain technology, coupled with robust fraud prevention strategies, we can create a safer environment for cryptocurrency users. Educating oneself about common scams, implementing strong security measures, and relying on trusted security solutions like Quick Heal Total Security are essential steps in protecting against digital currency fraud. By working together and staying informed, we can harness the power of blockchain to overcome the cryptocurrency scam epidemic.

No Comments, Be The First!